Fundamentals of Inheritance (Faraid) in Islam: Ensuring Fair Distribution

Introduction

Faraid, the Islamic law of inheritance, is a fundamental component of Shariah that ensures the just and equitable distribution of a deceased person's estate among rightful heirs [1]. Rooted in the Qur'an, Hadith and Islamic jurisprudence, Faraid addresses both the spiritual and social dimensions of wealth distribution, aiming to prevent disputes and maintain family harmony. This article explores the definition, pillars, conditions, allocation of Faraid, obstacles to receiving inheritance, and practical examples of inheritance calculation.

Definition of Faraid

Faraid refers to the obligatory shares of inheritance assigned to specific heirs as prescribed in Islamic law. The term "Faraid" is derived from the Arabic word "Faridah," meaning something that is made obligatory or mandatory. The principles of Faraid are primarily derived from the Qur'an and Sunnah, ensuring that the distribution of wealth after death is conducted fairly and justly [2].

In Islamic jurisprudence, when a person dies before the inheritance distribution takes place, it is essential first to settle any debts and fulfill any outstanding obligations of the deceased. This includes the payment of funeral expenses and any bequests made within one-third of the estate. Only after these obligations are settled can the remaining estate be distributed according to the shares specified in the Qur'an and Hadith. This process ensures that the rights of creditors and the wishes of the deceased are respected before the heirs receive their shares. This principle is derived from the Qur'anic verse: "After payment of legacies they may have bequeathed or debts..." (Qur'an, 4:12), which emphasizes the priority of debts and bequests over the distribution of inheritance.

Pillars of Faraid

The pillars of Faraid [3] are the essential components that must be present for the distribution of inheritance to take place according to Islamic law. They include:

- Al-Muwarrith (The Deceased): The person whose estate is to be distributed after death.

- Al-Warith (The Heirs): The individuals who are entitled to receive shares of the deceased’s estate.

- Al-Mawruth (The Inheritance): The wealth and property left behind by the deceased.

Conditions of Faraid

For the distribution of Faraid to be valid, certain conditions [4] must be met:

- Actual Death of the Deceased: The inheritance process begins only after the confirmed death of the individual.

- Survival of Heirs: Heirs must be alive at the time of the deceased’s death to be eligible for inheritance.

- Eligibility of Heirs: The heirs must be eligible under Islamic law to receive their respective shares.

Allocation of Faraid to Heirs

The allocation of Faraid is detailed in the Qur'an and Hadith, specifying the shares for different categories of heirs. The primary heirs include spouses, children, parents, and siblings. Additional heirs such as aunts, uncles, nieces, nephews, and grandparents also have specified shares. The following sections outline the shares for each category with references from the Qur'an and Hadith.

- Spouses

- Husband: Receives half of the estate if there are no children, and one-fourth if there are children.

In what your wives leave, your share is a half if they leave no child; but if they leave a child, you get a fourth after payment of legacies they may have bequeathed or debts..." (Qur'an, 4:12).

- Wife: Receives one-fourth of the estate if there are no children, and one-eighth if there are children.

"In what you leave, their share is a fourth if you leave no child; but if you leave a child, they get an eighth after payment of legacies you may have bequeathed or debts..." (Qur'an, 4:12).

- Children

- Sons: Receive a share equal to twice that of daughters.

"Allah commands you regarding your children: for the male, what is equal to the share of two females..." (Qur'an, 4:11).

- Daughters: Receive a fixed share of one-half if she is the only child, and two-thirds if there are two or more daughters and no sons.

"If only one daughter, her share is half. If two or more, their share is two-thirds of the inheritance..." (Qur'an, 4:11).

- Parents

- Mother: Receives one-sixth if there are children, and one-third if there are no children.

"For parents, a sixth share of inheritance to each if the deceased left children; if no children, and the parents are the (only) heirs, the mother has a third..." (Qur'an, 4:11).

- Father: Receives one-sixth if there are children. In the absence of children, the father’s share is often calculated as the residue after the distribution of other fixed shares.

- Grandparents

- Grandmother: Receives one-sixth of the estate if there are no surviving mother or father. This is derived from the general principles of Islamic inheritance and supported by various Hadith.

The Hadith states: "The Prophet (PBUH) assigned one-sixth to the grandmother when the deceased had no mother" (Sunan Abu Dawud, Vol. 3, Book 10, Hadith 2895).

- Grandfather: In the absence of the father, the grandfather takes a similar role and may receive a share. The specific share can vary, but it is often considered similar to that of the father. In some cases, he may receive one-sixth, and in others, he may receive the residue after other fixed shares have been allocated.

The Hadith provides guidance on the allocation: "The grandfather inherits in the absence of the father and receives what the father would have inherited" (Sunan Ibn Majah, Vol. 4, Book 24, Hadith 2738).

- Siblings

- Brothers and Sisters: Their shares vary depending on the presence of children, parents, and other factors.

"If a man or woman leaves neither ascendants nor descendants, but has left a brother or a sister, each one of the two gets a sixth; but if more than two, they share in a third..." (Qur'an, 4:12).

- Aunts and Uncles

- Paternal Uncles and Aunts: If the deceased has no direct descendants (children) or ascendants (parents), paternal uncles and aunts may inherit. Paternal uncles generally receive a share equivalent to the residue of the estate, while paternal aunts receive half the share of paternal uncles. The specific shares can vary based on the presence of other heirs.

The Qur'an does not specify the exact shares for aunts and uncles directly, but their shares can be derived through the principle of 'Asaba' (residuary heirs). The Hadith also guides this, as stated in Sahih Bukhari: "Give the Faraid (the shares prescribed in the Qur'an) to those who are entitled to receive it. Then whatever remains should be given to the closest male relative of the deceased" (Sahih Bukhari, Vol. 8, Book 80, Hadith 6732).

- Nieces and Nephews

- Nephews (Brother's Son): If there are no direct descendants or ascendants, nephews can inherit. A brother's son often receives a share of the estate as per the rules of male agnatic (male line) inheritance.

- Nieces: Similarly, a niece can inherit if there are no direct descendants or ascendants, often receiving half the share of her male counterpart (brother's son).

The shares for nephews and nieces are derived based on the concept of residuary inheritance ('Asaba).

The following Hadith provides a basis for this: "The son of a brother (nephew) takes precedence over more distant male relatives" (Jami' at-Tirmidhi, Vol. 3, Book 15, Hadith 2115).

Obstacles to Receiving Inheritance

There are specific conditions under Islamic law that can prevent an heir from receiving their inheritance. These obstacles are known as "Mawani" and include:

- Homicide: An heir who intentionally kills the deceased is disqualified from receiving any share of the inheritance. The Prophet Muhammad (PBUH) said, "The killer does not inherit" (Sahih al-Bukhari, Vol. 8, Book 80, Hadith 762).

- Difference in Religion: A non-Muslim cannot inherit from a Muslim, and vice versa. The Prophet Muhammad (PBUH) said, "A Muslim does not inherit from a disbeliever, nor does a disbeliever inherit from a Muslim" (Sahih Muslim, Book 11, Hadith 1614).

- Slavery: A slave cannot inherit, as they are considered the property of their master and thus do not have the legal capacity to own property independently [5].

Practical Examples of Inheritance Calculation

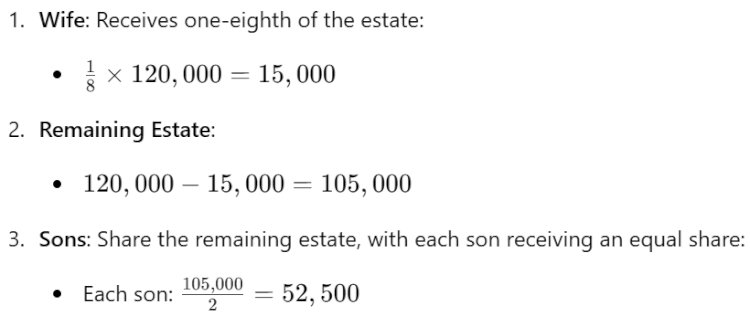

Example 1: Basic Scenario

A man dies leaving behind a wife and two sons. The estate is valued at RM120,000.

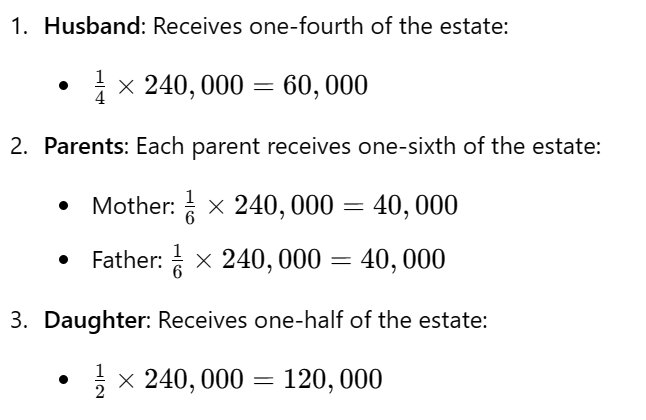

Example 2: Complex Scenario with Multiple Heirs

A woman dies leaving behind a husband, one daughter, and her parents. The estate is valued at RM240,000.

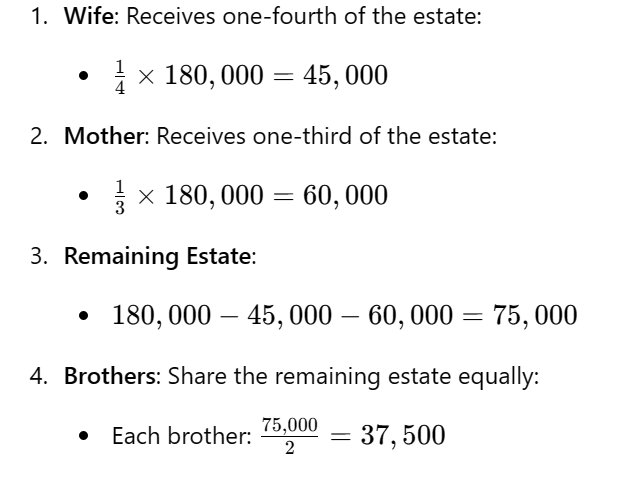

Example 3: Scenario with No Direct Descendants

A man dies leaving behind a wife, mother, and two brothers. The estate is valued at RM180,000.

Conclusion

Faraid, as prescribed in Islamic law, is a comprehensive system that ensures fair and just distribution of a deceased person’s estate. By adhering to the principles outlined in the Qur'an, Hadith, and Islamic jurisprudence, Muslims can maintain social justice and family harmony. Understanding the fundamental aspects of Faraid and applying them accurately is essential for preserving the rights of all heirs and upholding the values of Islamic inheritance laws.

References

- Ahmad Ibrahim, Malaysian Family Law (Malay: Undang-Undang Keluarga Malaysia). Kuala Lumpur: Dewan Bahasa dan Pustaka, 2010, p. 45.

- Al-Qurtubi, Muhammad ibn Ahmad. Al-Jami’ li Ahkam al-Qur’an. Beirut: Dar al-Kutub al-‘Ilmiyyah, Vol. 5, p. 190.

- Al-Sarakhsi, Muhammad ibn Ahmad. Al-Mabsut. Beirut: Dar Al-Ma’rifah, Vol. 30, p. 150.

- Al-Sarakhsi, Muhammad ibn Ahmad. Al-Mabsut. Beirut: Dar Al-Ma’rifah, Vol. 30, p. 200.

- Al-Qurtubi, Muhammad ibn Ahmad. Al-Jami’ li Ahkam al-Qur’an. Beirut: Dar al-Kutub al-‘Ilmiyyah, Vol. 5, p. 210.

About the author:

Dr. Fatimah binti Karim is an Assistant Professor of Department Fiqh and Usul al-Fiqh, at the International Islamic University Malaysia (IIUM), Kuala Lumpur.

Disclaimer

The views expressed in this article are the author’s own and do not necessarily mirror Islamonweb’s editorial stance.

1 Comments

-

Salaam Alekum. I am a muslim convert with christian family from my previous life. I want to change my current Wasiya (which was written prior to my conversion) to conform to the Faraid. how can this be done and be accepted by the secular courts in western countries. Can my Muslin children truly benifit from this change. Thankyou

-

Web Desk

10 months ago

It's better you consult with the local Islamic centre where you are residing. They will be able to help you in this matter.

-

Leave A Comment